BANK BRADESCO (BBD)·Q4 2025 Earnings Summary

Bradesco Beats Estimates but Stock Falls 3% as 2026 Guidance Disappoints

February 6, 2026 · by Fintool AI Agent

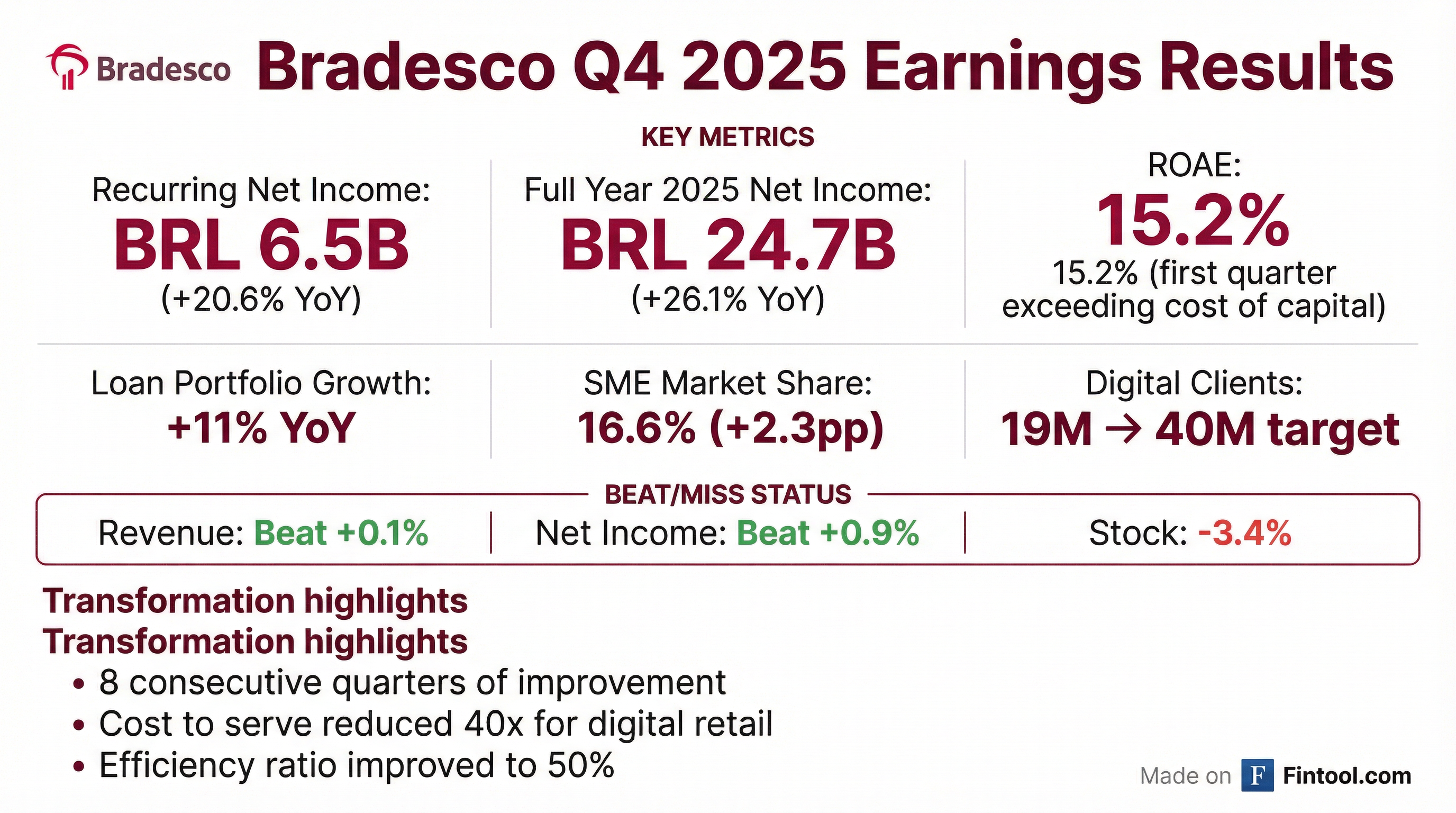

Banco Bradesco (BBD) delivered a solid Q4 2025 with revenue and earnings modestly beating consensus, but shares fell ~3% as 2026 guidance came in below elevated expectations. After a stunning 106% rally since December 2024, the market had priced in more aggressive growth targets than the 8.5-10.5% loan portfolio growth management guided .

The quarter marked a milestone: ROAE hit 15.2%, exceeding Bradesco's cost of capital for the first time since the transformation plan launched in February 2024 . CEO Marcelo Noronha emphasized this is the result of disciplined execution over 8 consecutive quarters, with the aircraft "never flying backwards" .

Did Bradesco Beat Earnings?

Yes — Bradesco beat on both revenue and net income, though by slim margins:

Values retrieved from S&P Global

The full year picture is more impressive: 2025 recurring net income reached BRL 24.7 billion, up 26.1% year-over-year . This represents 8 consecutive quarters of improvement since the transformation plan launched.

How Did the Stock React?

BBD shares fell 3.4% to $3.87 on earnings day despite the beat. The disconnect comes from expectations management:

- Coming in hot: Stock had rallied 106% from December 31, 2024 to earnings day

- Guidance reset: 2026 net income guidance implied ~BRL 27.5B at midpoint, below some Street estimates of BRL 30-31B

- Noronha's response: "Can you imagine today, with the level of conviction that we have... I am super confident in our organization"

Values retrieved from S&P Global

What Did Management Guide for 2026?

Management provided 2026 guidance that fell short of elevated Street expectations:

Key points from guidance:

- ROE to keep improving: Management reiterated the "aircraft will not fly backwards" — ROE will stay above 15.2%

- CET1 capital around 11%: Comfortable with capital levels despite regulatory headwinds (Basel 49.66, operating risk adjustments)

- Technology investment continues: 22% increase in 2025 will continue as competitiveness driver

What Changed From Last Quarter?

The transformation momentum accelerated in Q4:

Digital Transformation

- Digital retail clients: 19 million (up from prior quarters), targeting 40 million by year-end 2026

- BIA GenAI retention: 90% of digital calls resolved automatically

- Cost to serve: Reduced 40x for digital clients

SME Dominance

- Market share: Gained from 14.3% to 16.6% in SMEs (companies up to BRL 300M revenue)

- Managers deployed: 5,000+ managers across 2,100 service points

- NPS improvement: 56 → 74 points

Capital Markets Momentum

- Investment banking revenue: +29.2% YoY

- DCM market share: Highest since 2020/2022

Credit Quality

- NPL (90+ days): Flat and "totally easy"

- Stage 3 assets: Dropping quarter over quarter

- Problematic asset reduction: BRL 20.5B in restructured/problem assets resolved in 2025

Key Management Quotes

On transformation conviction:

"An airplane will never fly backwards. We are not going to fly backwards. It was 15.2% in this quarter, and we expect it to increase if we can deliver more and more." — CEO Marcelo Noronha

On guidance expectations:

"The market somehow started bringing the expectation of a net income to BRL 30-31 billion. The role of IR is to correct the course. You don't have a 30%-40% leap year-on-year because we continue to invest in our transformation."

On technology investment:

"I see technology as a big driver of our productivity and our ability to deliver a lot more to our clients with hyper-personalization... We will not give up on investing."

On digital transformation:

"90 million clients are already fully digital in the mass retail with a totally different value proposition... We anticipate 45 million fully digital by year-end. This is our mass retail bank."

Segment Performance

Detractors:

- Checking accounts: Weak

- Collections: Pressuring fee income

Q&A Highlights

On payroll loans (consignado): Management is "very optimistic" on private payroll loan growth, where Bradesco has lowest market share among segments. Models deployed 24/7 with risk-adjusted pricing. INSS segment has market challenges but still growing 6.8% vs 5% prior quarters .

On Cielo integration: Cielo undergoing significant transformation with separate teams for partners. Delivered tap on phone, new pricing (zero), app integration. Gave up some large account TPV rather than sacrifice profitability. Seeing "lot of traction" in SME acquiring .

On capital (CET1): Expecting CET1 around 11% throughout 2026, with regulatory measures (49.66, operating risk) already computed. Interest on equity payments increasing from BRL 14.5B to BRL 15-16B. Management confident in capital allocation discipline .

On expense growth: 8% OpEx growth includes ~3% from continued technology investment. Personnel expenses grew 5% in line with IPCA inflation. Ex-profit sharing, personnel growth was 2.5%. Efficiency ratio target of 40% by 2028 (currently 50%) .

Historical Net Income Trend (USD)

Values retrieved from S&P Global

Forward Catalysts

- ROE progression: Targeting continued improvement above 15.2%, with 40% efficiency ratio goal by 2028

- Digital scale: 19M → 40M digital clients by end of 2026 — massive cost leverage

- SME share gains: Market share from 16.6% with room to grow via government programs, receivables financing

- Private payroll loans: Lowest share among segments, deploying 24/7 AI-driven origination

- Interest rate sensitivity: Rate cuts could help more leveraged corporate clients

Risks and Concerns

- 2026 elections: Management expects "a little more volatility in the second half"

- Guidance disappointment: Street had higher expectations after 106% rally

- Brazil fiscal risk: Structural public debt concerns could weigh on market

- INSS headwinds: Market-wide challenges in INSS payroll lending

- Basel implementation: 49.66 timing pressure through 2026-2028

Bottom Line

Bradesco delivered a solid Q4 with the transformation playbook working — 8 straight quarters of improvement, ROE finally exceeding cost of capital, and SME market share gains. The stock pullback reflects a guidance reset after a massive 106% rally, not operational disappointment. Management's "aircraft never flies backwards" messaging signals confidence that ROE expansion continues in 2026, even if the slope is less aggressive than some hoped.

Data sourced from Bradesco Q4 2025 Earnings Call Transcript (February 6, 2026) and S&P Global.

Related: